LOCAL GOVERNMENT PENSION SCHEME

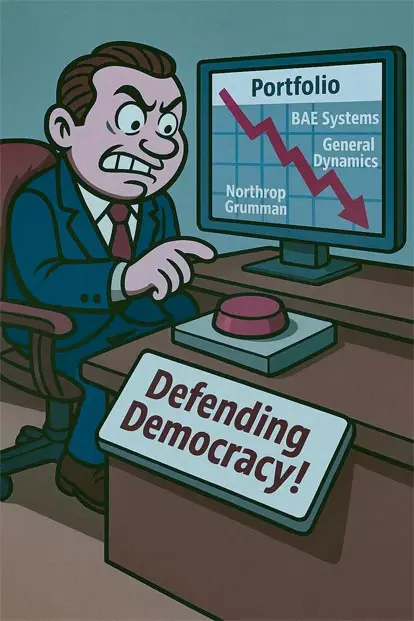

"Responsibly Investing" to profit from

War Profiteering

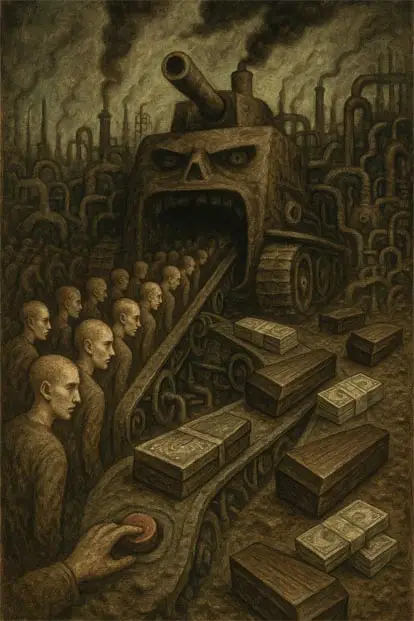

The business world has a long history of unethical war profiteering. During World War 1, Lloyd George had to enact numerous acts to limit private profits and price gouging. After the war a backlash against the "Merchants of Death" highlighted the evil trade, which the Nye Committee exposed as encouraging war to boost their profits...

Shareholding locks in endless war

When the wealthy elites and money managers have over $1.2 trillion invested in the arms trade, of course the last thing these most influential people want, would be a prolonged outbreak of peace...

We have long been warned...

“In the councils of government, we must guard against the acquisition of unwarranted influence... by the military-industrial complex. The potential for the disastrous rise of misplaced power exists and will persist.”

Pension Divest

Whether you are a patriot who does not want shareholders to suck our defence budget into their pockets, or you are opposed to profiteering from the never ending war, bloodshed and misery around the globe, we are here to help you prevent your pension fund from working against your best interests.

Pensions funds with values in the billions are understandably constrained by legal regulations. At Pension Divest we want to help concerned pension scheme members and willing pension fund committee members, to better understand the legal framework which govern LGPS ethical investment factoring. We try to show how within the law it is not only possible, but more legally consistent for funds to divest from the arms industry.

"UVision Hero-30" by Reise Reise, licensed under CC BY-SA 4.0

Does a "Responsible Investor" invest in...

- General Dynamics: Makes MK-84 2,000lb bombs

- Palantir: Artificial intelligence weapons targeting

- Rheinmetall: Merkava tank ammunition

- Thales: Russian tank's night vision systems

- Caterpillar: Military bulldozers

- Northrop Grumman: Land mine dispensing vehicles

- Safran: Russia's fighter jet GPS systems

- Renk: Merkava tank gearboxes

- Boeing: Attack helicopters & bombs

- BAE Systems: F-35 parts

These are just a few examples of companies in which LGPS schemes are investing your money.

Pension scheme members are shocked to learn that their pension pot is invested in this type of company. That shock alone could be proof of an ongoing deception.

The Brunel Pension Partnership state on their website front page "Forging better futures by investing for a world worth living in" but they make no mention that they are investing £10s of millions in these and many similar companies well known to supply dictatorships around the world, leaders accused of war crimes and even genocide.

What reasonable person, would think that public sector workers, who have spent their working lives putting people before profit, would find this use of their earnings "Responsible Investing"?

Pool companies manage 72% of the LGPS funds

Local council pension schemes

Million pension scheme members

BILLION Pounds Total across England, Scotland & Wales

Know your pool company

Much of the investing of your money has been delegated to companies with very little control or oversight by your council fund administrators. These are professional money people, the cutting edge of capitalism

Actions for councillors and employers

Council motion and member survey

Councils and other LGPS scheme employers have a duty to consider the welfare of their employees. Our research shows many LGPS scheme members are morally impacted by their earnings being invested to profit from war. Please download a motion which can be put before your council and a survey which can be used by any scheme employer.

Please click here to download the motion and survey

We have received some questions from councillors who are considering proposing the motion, please find our answers here. If you have any further questions about the motion please get in touch.

Urgent Action

Calling AVON Pension Fund members

Your fund are planning a consultation and we have grave concerns over the wording they will use.

Please click here to read more and sign the letter

Calling GLOUCESTERSHIRE Pension Fund members

Your fund is heavily invested in the arms trade. Join local scheme members in signing a letter to request a consultation of all members, over the continuation of these investments.

Please click here to read more and sign the letter

Calling BUCKINGHAMSHIRE Pension Fund members

Your fund is heavily invested in the arms trade. Join local scheme members in signing a letter to request a consultation of all members, over the continuation of these investments.

Please click here to read more and sign the letter

Actions for other pension fund members

Grass roots organising is needed initially to simply tell funds that members prefer their pension to be free of the profits from war.Once a number of members from an area have joined, we will ask that fund for a consultation of their other scheme members, so the fund can prove what they already know - it is a commonly held preference among their members.

We will also monitor the actions of the fund to make sure they are honest and forthright when explaining about the option to divest from arms.

It couldn't be easier, just enter your name below and tell us which fund you are in.

- We will add your name to the list when we communicate with the fund, to indicate a preference for excluding arms investments and in calling for a fair consultation of other members.

- We will message you when your pension fund carries out a member consultation, to make sure you can have your say.

Contact your scheme directly

Whether you have joined the campaign or not, you can make a really big difference by sending an individual email to the pension fund administrators. Not many people do it, so each email makes a big impact, more so if it is your own words rather than a preformatted email. To be most effective it is important that these key points are made. In your own words tell them -

- My pension is with this scheme.

- I do NOT want my pension invested in weapons manufacturers.

- I do NOT believe taking dividends from arms companies is good for national security.

- I do NOT want my pension scheme to put profit before people.

You can easily find the contact details for your fund on the LGPS Member website.

After you have done that please share a link to this website with your friends and colleagues.

Actions for NON-scheme members

It is really important that the request for divestment is made by scheme members but due to the humanity wide impact of arms trade, it is a legitimate concern for all people.

If you would like to be involved in the campaign to raise awareness among scheme members, the vast majority simply don't know what their money is invested in, please email pensiondivest@pm.me and we can put you in touch with your nearest local campaigners.

Information for campaigners & committee members

The barrier to divestment in some funds is not the pension fund committee members but the council officers, who have been seen misleading committee members and campaigners alike, with incomplete and even false information. So it is essential to understand the legal situation.

Key Findings

- Funds are legally able to divest: Many replies to requests to stop investing in weapons manufacturers are false claims that the fund's hands are legally tied and they have a fiduciary duty to make the absolute maximum profit regardless of all else. In fact it is explicit in law that they are allowed to take non-financial factors into consideration even when it might give less than the absolute maximum return.

- A proper process MUST be followed: While it seems clearly legal to divest, the law around this leaves only a very narrow window of acceptable reasons to do so. The schemes operate for member benefit so the decision to divest must be arrived at by a reasonable method or the decision could be overturned.

- It is not a political request: It is very common for council officers to falsely claim that requesting divestment from arms manufacturers is a "political view". Rather it is a moral and ethical consideration that transcends politics. Officers often misquote a court decision which does not actually support their reason for claiming they cannot divest.

- Investment Strategy Statement (ISS): Council administrators issue an ISS (Statement of Investment Principles in Scotland) that sets guidelines for the employees who make the investment decisions. A situation exists where committee members lack sufficient knowledge to create the ISS without relying heavily on the advice of those same employees the ISS is supposed to control. These ISS’s give minimum restraint over the employees. The unethical investments that result of that minimal restraint are then not inspected in detail by council fund administrators who rely on the same employees to provide the oversight. If there are failures in fiduciary duty, this is one.

- Ethics washing: In order to win scheme members trust, pension fund branding strongly emphasizes human rights and responsible investing, because they know that is what the majority of scheme members want. Only after difficult investigation can the ugly reality be seen to be far from aligning with societal moral norms. Deliberate deception would very likely be an illegal breach of trust, which is a fundamental fiduciary duty.

- UK Stewardship Code 2020: Some LGPS and most Pool companies are signatories. The code emphasizes engagement with beneficiaries on what is important to them, among other things, to avoid negative social impacts. It could reasonably be considered a negative social outcome for scheme members to know their earnings are invested in weapons manufacturers against their will. Signatories have a responsibility to integrate social factors important to beneficiaries into investment policy.

Some usual excuses

Many people across the country are challenging their LGPS administrators due to concerns that their money could be contributing to the endless cycle of war and profiting from the arms trade.

Instead of correcting their course, these are some of the usual excuses given for ignoring scheme members:

"We're engaging"

“If we divest we'll lose power to influence the companies”

It is one thing to ask a regular company to make some environmental concessions, when that is the way things are going anyway. However there is no credibility to a claim that holding 0.005% of the shares of rapid land mine dispensing system manufacturer Northrop Grumman, will give a pension fund enough influence to stop them doing the number one thing they do to make money - its a weapons manufacturer. If they did comply, the shares would dramatically fall in value as weapons are 88% of their revenue stream.

- The majority of arms shareholders are in USA where it is illegal to restrict investments for ethical reasons, it is mathematically impossible that UK shareholders can vote to reduce these companies weapons output.

- Pension fund fiduciaries (the pension committee members) are legally obliged to tell you the truth. If they claim to be currently engaging with these companies, ask for proof. If they cannot provide it, it could be proof of their dishonesty.

- There are clear expectations on signatories of the UK Stewardship Code 2020 to report on their engagement and explain "how outcomes of engagement have informed investment decisions (buy, sell, hold)". Demand this from your fund.

“We don’t own the shares…”

"We only own a share of a fund that contains the shares"

The pension funds jointly own the pool companies (Brunel etc) and pay for their employees to buy the shares on their behalf, with the funds money, following the funds instructions, and who are provided details of the proportion of the specific company shares owned by each fund, down to the penny, which the fund signs off on and the fund retains full legal responsibility of oversight for. Despite that its the case that pension committee members might not know where all the money is invested, once it is in a Blackrock type financial product.

“You're not a scheme member”

"We can't listen to mere tax-payers"

The Supreme Court agreed that taxpayers DO have "a legitimate interest in regulating how public sector pension schemes manage the money" just not a controlling interest, the same as the government doesn't have a controlling ability to dictate investments.

“We can’t take a political position”

"We're legally unable to listen to political protest"

This is somewhat true, it was agreed by the Supreme Court that the Funds must not be ruled by the government's political positions. Though this excuse is often given to members who are not asking funds to follow their politics but merely to comply with societal moral norms and ethics which the funds already portray themselves as following.

“It will cost too much to divest”

"There will be penalties and costs"

The financial advisors will make a vague claim of this. It's true there are transaction fees to liquid stock trades and bond sales, though taken as a whole the weapons companies have risen significantly since October 7th so the profits should cover costs of a decisive divestment.

“We don't have to listen to scheme members”

"We can, but we don't have to"

This is true as the law stands. Even though it is the scheme member's earnings, once they have entrusted it to the scheme administrators it is down to them. This relationship makes the information provided by the schemes to the members, showing why members can trust in their responsible investor credentials, absolutely critical in terms of honesty and transparency.

Let us help

If you have a reluctant fund administration and are seemingly at a dead end, or if you are unsure how to start, get in touch by emailing pensiondivest@pm.me

We will go through your fund's policy documents and draw up a tailored action plan to help you take your initiative forward.

Working together we are stronger.